As athletes, we often see them as heroes on the field, court, or track. They are admired for their athletic abilities, dedication, and hard work. However, behind the fame and fortune lies a lesser-known aspect of being an athlete – taxes. Like any other profession, athletes are not exempt from paying taxes on their earnings. In fact, due to their high salaries, they may even face higher tax rates compared to the average person.

In this article, we will take a deep dive into the world of athlete taxes. We will discuss the different types of taxes that athletes have to pay, the factors that affect their tax rates, and how they can optimize their tax payments. We will also look at some real-life examples of famous athletes and their tax situations. So let’s get started.

The Different Types of Taxes Athletes Have to Pay

When it comes to taxes, there is no one-size-fits-all approach. Athletes, like any other individual, have to pay several types of taxes depending on their income, residency status, and location of their team. Here are some of the main types of taxes that athletes have to pay:

Federal Income Tax

Federal income tax is the most common type of tax that all individuals, including athletes, have to pay. This tax is based on the income earned by an individual throughout the year. The United States operates on a progressive tax system, which means that the more you earn, the higher your tax rate will be. The federal income tax rate for athletes can range from 10-37%, depending on their income bracket.

State Income Tax

Apart from federal income tax, athletes may also have to pay state income tax if they reside in a state with an income tax system. The tax rate for state income tax varies from state to state, with some states having higher tax rates than others. For example, California has a top tax rate of 13.3%, while Texas has no state income tax.

Local Income Tax

In addition to federal and state income tax, athletes may also have to pay local income taxes depending on where they reside. These taxes are typically in the form of city or county taxes and are imposed by the local government. The tax rate for local income tax can range from 0-3%, depending on the location.

Self-Employment Tax

When it comes to professional athletes, most of them are considered self-employed individuals. This means that they have to pay an additional tax known as the self-employment tax. This tax is equivalent to the Social Security and Medicare taxes paid by regular employees, but since athletes are self-employed, they have to pay the full amount, which is 15.3% of their income.

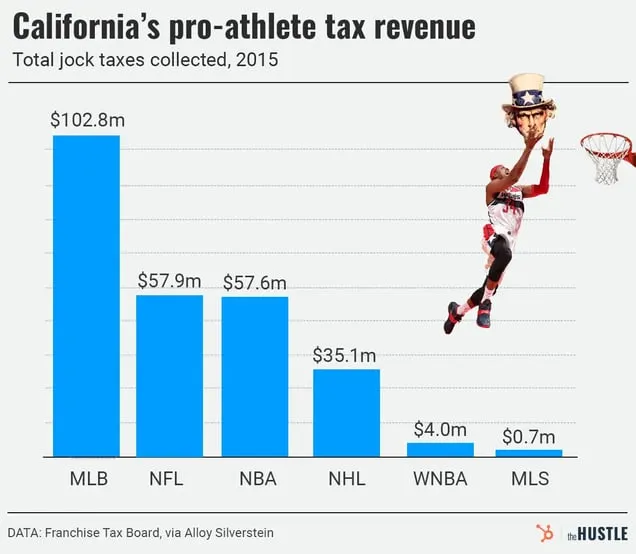

Jock Tax

The jock tax is a term used to refer to the taxes that athletes have to pay when they play games or participate in events in states where they do not reside. These taxes are imposed by the state or city where the game or event takes place. Athletes who make a significant income may end up paying a substantial amount of jock taxes, which can significantly affect their overall tax liability.

Factors That Affect Athlete Tax Rates

As mentioned earlier, taxes for athletes are not a one-size-fits-all situation. Several factors can affect the tax rates of athletes, including their income level, residency status, and location of their team. Let’s take a closer look at these factors and how they impact athlete taxes.

Income Level

One of the main factors that affect athlete tax rates is their income level. As we know, the United States operates on a progressive tax system, which means that the more an individual earns, the higher their tax rate will be. Professional athletes, who often earn millions of dollars per year, fall into the highest tax bracket and are subject to the highest tax rates.

Residency Status

An athlete’s residency status also plays a significant role in determining their tax rates. Athletes who reside in states with high income tax rates may end up paying more in taxes compared to those residing in states with no income tax. In addition, non-resident athletes may also have to pay jock taxes when they play games or participate in events in other states.

Location of Team

The location of an athlete’s team can also affect their tax rates. This is because each state has its own tax laws, and some states have higher tax rates than others. For example, athletes playing for teams located in California or New York may end up paying significantly higher taxes compared to those playing for teams in Florida or Texas, which have no state income tax.

Optimizing Athlete Tax Payments

With all these different types of taxes and factors to consider, it’s no wonder that athletes may feel overwhelmed when it comes to their tax payments. However, there are ways that athletes can optimize their tax payments and potentially lower their overall tax liability. Here are some strategies that athletes can use to optimize their tax situation:

Tax Planning

As with any profession, proper tax planning is essential for athletes. By working closely with a tax professional, athletes can strategically plan their income, deductions, and investments to minimize their tax liability. This includes taking advantage of tax breaks and deferring income to lower tax years.

State Tax Residency

Since an athlete’s residency status can significantly impact their tax rates, it’s crucial for them to consider where they officially reside. Some athletes may choose to establish their residency in a state with lower tax rates to optimize their tax payments. However, this can be a complicated process and may require substantial proof of residency.

Retirement Plans

Athletes, like anyone else, can contribute to retirement plans such as 401(k)s and IRAs to save for their future while also lowering their taxable income. In addition, contributing to a retirement plan may also make the athlete eligible for tax deductions, potentially reducing their overall tax liability.

Tax Credits

Tax credits are a great way for athletes to lower their tax payments. These credits are applied directly against the taxes owed and can significantly reduce an athlete’s tax liability. Some common tax credits that athletes may be eligible for include the Child Tax Credit, the Earned Income Tax Credit, and the American Opportunity Tax Credit.

Famous Athlete Tax Situations

Now let’s take a look at some real-life examples of famous athletes and their tax situations.

LeBron James

LeBron James is not only one of the greatest basketball players of all time, but he is also known for his massive wealth. With an estimated net worth of over $500 million, it’s safe to say that James falls into the highest tax bracket. As a resident of California, James has to pay state income tax at a rate of 13.3%. However, when he played for the Miami Heat, a team located in Florida with no state income tax, he was able to save on state taxes.

Lionel Messi

Argentine football superstar Lionel Messi is another athlete who faces high tax rates due to his high earnings. As a resident of Spain, Messi has to pay a top tax rate of 45%, which applies to incomes over €60,000. However, by taking advantage of the “Beckham Law,” which allows non-Spanish residents to pay a flat tax rate of 24% instead of the regular progressive tax system, Messi was able to significantly reduce his taxes.

Michael Phelps

The most decorated Olympian of all time, Michael Phelps, faced a unique tax situation during the 2008 Beijing Olympics. Phelps’s eight gold medals earned him a cash prize of $1 million from the United States Olympic Committee, which was subject to federal and state income tax. However, thanks to a bill passed by Congress in 2016, Olympic athletes can now exclude up to $10,000 in Olympic winnings from their taxable income.

Conclusion

Paying taxes is an inevitable part of being an athlete, regardless of how famous or wealthy they are. With high salaries, multiple types of taxes, and various factors to consider, athletes have to navigate through a complex tax system. However, with proper tax planning and optimization strategies, athletes can potentially reduce their tax liability and keep more of their hard-earned money. So the next time you’re watching your favorite athlete on the field, remember that behind all the fame and fortune lies a significant tax burden.